Blockchain Property Investment: Maximizing Returns

Blockchain technology has revolutionized various industries, and the realm of real estate is no exception. In recent years, the integration of blockchain in property investment has opened up new avenues for investors seeking transparency, security, and efficiency. This article explores key strategies that can help maximize returns in blockchain-based property investments.

Understanding Blockchain in Real Estate

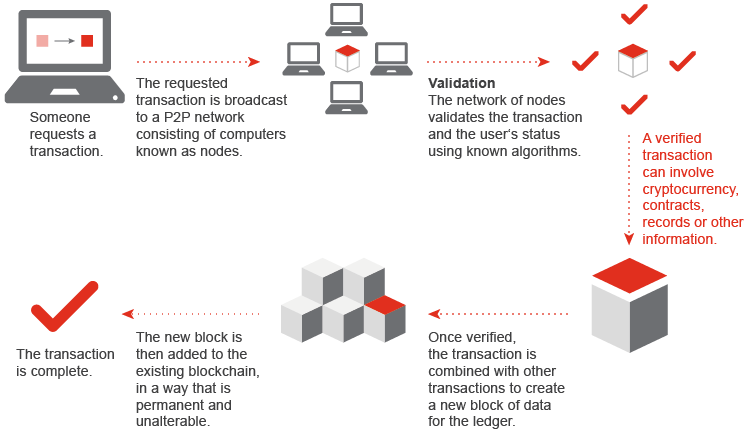

Before delving into investment strategies, it’s essential to grasp the fundamentals of blockchain technology in the real estate sector. Blockchain ensures transparency by maintaining an unalterable ledger of property transactions. This decentralized approach reduces fraud, streamlines processes, and establishes trust among parties involved in real estate transactions.

Tokenization: Breaking Down Property Value

One of the groundbreaking strategies in blockchain property investment is tokenization. This involves breaking down property values into digital tokens, allowing investors to own a fraction of a property. Tokenization not only lowers the barrier to entry for investors but also enhances liquidity in the real estate market, making it easier to buy and sell property shares.

Smart Contracts for Seamless Transactions

Smart contracts, self-executing contracts with the terms of the agreement directly written into code, play a pivotal role in blockchain property investment. These contracts automate and enforce property transactions, reducing the need for intermediaries and minimizing the risk of errors or fraud. Smart contracts streamline the buying and selling process, providing a secure and efficient way to transfer property ownership.

Decentralized Finance (DeFi) Platforms

The integration of blockchain and decentralized finance (DeFi) platforms has further transformed property investment. These platforms facilitate peer-to-peer lending, borrowing, and trading of property assets without traditional financial intermediaries. Utilizing DeFi in blockchain property investment can potentially yield higher returns and offer more flexibility in managing investments.

Risk Mitigation through Transparency

Transparency is a hallmark of blockchain technology. In the context of property investment, this transparency can be a powerful tool for risk mitigation. Blockchain’s immutable ledger ensures that all transactions are recorded and accessible, reducing the risk of fraud or disputes. Investors can make more informed decisions by accessing a transparent and traceable history of property transactions.

Diversification with Global Investment Opportunities

Blockchain property investment opens the door to global opportunities. Through tokenization and decentralized platforms, investors can diversify their portfolios by investing in properties worldwide. This global reach provides a hedge against regional market fluctuations and allows investors to capitalize on emerging real estate markets.

Connecting Blockchain Property Investment Strategies

To implement successful blockchain property investment strategies, it’s crucial to stay informed about the latest developments and opportunities in the market. Organizations like waslinfo.org are dedicated to providing valuable insights and resources for investors navigating the intersection of blockchain and real estate.

Conclusion: Embracing the Future of Real Estate Investment

Blockchain Property Investment strategies are reshaping the landscape of real estate investment. From tokenization to smart contracts and decentralized finance, these strategies offer a more efficient, transparent, and accessible approach to property investment. As the industry continues to evolve, staying informed and leveraging platforms like waslinfo.org will be key to maximizing returns and navigating the exciting future of blockchain-based property investment.